Sep

eSIM Frauds: How Scammers Hijack Your Phone

-

Rahul Mishra / 6 months

- September 9, 2025

- 0

Introduction

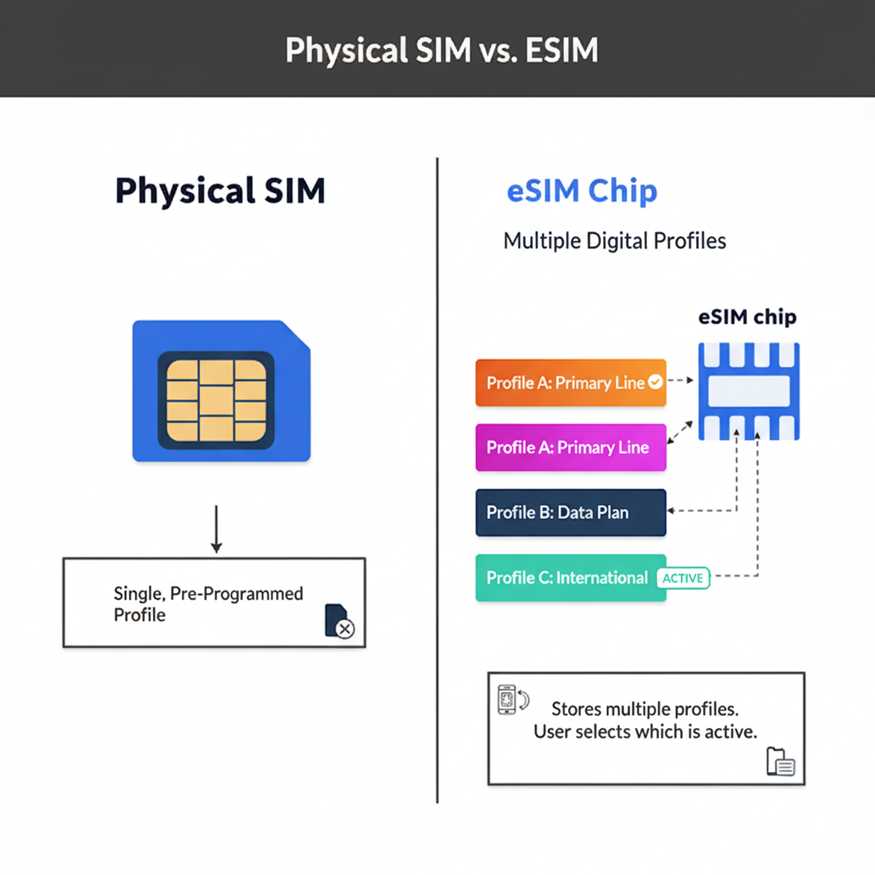

Many modern phones use an eSIM which stands for (embedded sim) instead of a physical SIM card. An eSIM is a tiny digital chip built into the phone that can be activated remotely. You might get an eSIM by scanning a QR code or clicking a link from your carrier, instead of swapping a plastic SIM. This makes it easy to switch carriers or add lines without going to a store.

Unfortunately, criminals have started abusing this flexibility. They trick people into switching to an eSIM so the victim’s phone number moves onto the scammer’s device. In that moment, the victim’s phone loses service and all incoming texts and calls go to the fraudster instead.

How the eSIM Scam Works

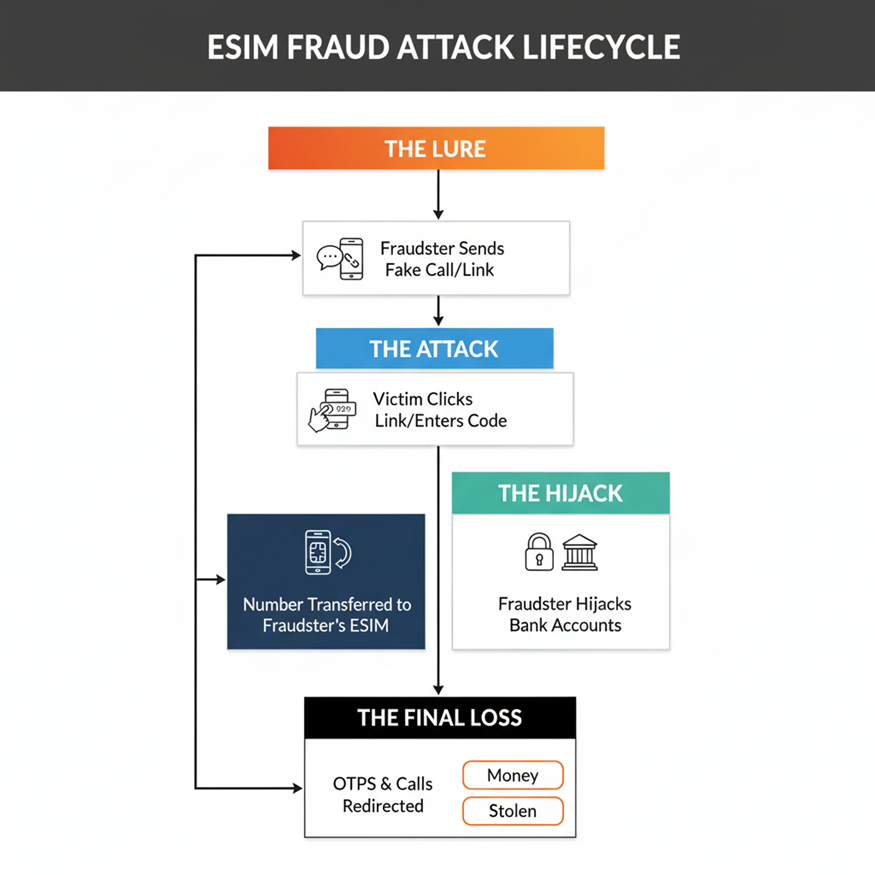

Scammers use social engineering (fake calls or messages) to force a phone number onto an eSIM they control.

Fake calls and links: A fraudster calls or messages you, pretending to be from your mobile carrier or bank. They say you need to activate a new “eSIM” feature for some reason. They send a special activation link or code by SMS or email.

Converting your SIM: If you click the link or enter the code, your phone will switch your number from the physical SIM card to the scammer’s eSIM. Your phone then loses signal because the old SIM is deactivated.

Stealing your OTPs: With your number on their eSIM, the cyber criminal’s phone starts receiving all calls and messages meant for you, including one time passwords (OTPs) sent by your bank or other services.

Withdrawing money: The scammers quickly use those OTP codes to approve money transfers or payments. Because the codes go to them, they can empty your bank account even if you never gave them your password or ATM card.

The Indian Cybercrime Centre (I4C) reported a case where scammers first disabled the victim’s physical SIM via an eSIM link. After the switch, all calls and messages, including the OTPs, are then redirected to the eSIM” owned by the fraudsters. They then used those OTPs to steal lakhs of rupees.

Reference

Recent Cases and Warnings in India

Indian authorities have sounded the alarm about these eSIM scams. As we mentioned above In August 2025, the Indian Cybercrime Coordination Centre (I4C) and tech news sites reported new eSIM fraud cases. Victims in India have lost large amounts of money, For example:

Noida case (₹27 lakh stolen): A 44 year old woman in Noida got a whatsApp call from someone posing as a telecom customer care agent. The caller guided her to activate eSIM by entering a code on her phone. Her SIM was immediately deactivated. A few days later, scammers broke her fixed deposit, withdrew money from her bank accounts, and even took a loan in her name totalling about ₹27 lakh stolen.

News outlets also describe similar cases (e.g. a Mumbai victim losing ₹4 lakh in minutes) where a fake activation link caused a quick transfer of money. In each case, the pattern is the same a trusted sounding call, an eSIM activation link, and the instant hijacking of OTPs.

I4C issued a formal warning and tips

I4C advised people to “beware of unknown callers and links” and to only request an eSIM through official methods. They also said that if your phone suddenly loses service for no reason, you should immediately contact your bank and mobile provider.

The Indian government is also taking broader action. Officials reported that they blacklisted hundreds of thousands of SIM cards suspected of fraud as part of financial scam prevention efforts. This shows how seriously regulators are treating mobile fraud, though it’s hard to stop every attack.

Global Trends in SIM Fraud

eSIM scams are part of a global rise in SIM swapping and mobile hijacking. Worldwide, criminals exploit phone number transfers to access accounts. A few facts from other countries:

-

- In the United States, the FBI investigated 1,075 SIM swap fraud cases in 2023, with losses approaching $50 million. For example, one American customer lost $38,000 when a fraudster convinced Xfinity Mobile to transfer his number.

-

- In the United Kingdom, fraud reports spiked dramatically. The UK’s fraud tracking service (Cifas) found that SIM swap scams jumped by over 1,000% between 2023 and 2024.

Reference

- In the United Kingdom, fraud reports spiked dramatically. The UK’s fraud tracking service (Cifas) found that SIM swap scams jumped by over 1,000% between 2023 and 2024.

-

- In Australia, a cybersecurity group (IDCARE) reported SIM swap and number porting cases surged 240% in 2024 compared to 2023, about 90% of those attacks happened without any action by the victim.

Reference

- In Australia, a cybersecurity group (IDCARE) reported SIM swap and number porting cases surged 240% in 2024 compared to 2023, about 90% of those attacks happened without any action by the victim.

These trends Shows that SIM and eSIM fraud are not limited to one region. As more people use eSIMs worldwide, attackers adapt their tactics.

Common Scam Message Formats (as reported by authorities)

These are not verbatim messages, but closely mirror fraudulent templates used in multiple Indian cases:

-

- “Dear customer, your SIM card will be blocked in 24 hours due to pending KYC/eKYC. Please update now.”Scammers use such messages to create a false sense of urgency, tricking victims into following unsafe instructions.

Reference

- “Dear customer, your SIM card will be blocked in 24 hours due to pending KYC/eKYC. Please update now.”Scammers use such messages to create a false sense of urgency, tricking victims into following unsafe instructions.

-

- “Please update your KYC details online by forwarding the email ID sent to your registered email to our customer care.”In many cases, these emails were sent by fraudsters rather than the legitimate carrier.

Reference

- “Please update your KYC details online by forwarding the email ID sent to your registered email to our customer care.”In many cases, these emails were sent by fraudsters rather than the legitimate carrier.

-

- “Your SIM is scheduled for eSIM activation. Click the email link and submit form.”

This prompts victims to unknowingly submit personal and bank details.

- “Your SIM is scheduled for eSIM activation. Click the email link and submit form.”

How to Protect Yourself From Such Scams

Avoid random links or callers: Never click on an eSIM activation link or share authorization codes if you didn’t request them. If someone calls or messages you with a link or code, hang up and verify by contacting your carrier directly through their official number.

Use official channels for eSIM: Always switch to an eSIM only through your carrier’s official app, website, or customer service. Avoid unknown third-party sites or shared links. Activation should be done in person at a store or via your account settings, not through random messages.

React if you lose signal suddenly: If your phone unexpectedly shows “No Service” or loses network without reason, act immediately. Call your mobile operator from another phone to report a possible hijack and notify your bank right away. Quick action can help freeze fraudulent transactions before money is stolen.

By staying alert and following official procedures, users can greatly reduce the risk. The key is to remember that no legitimate carrier or bank will ever ask you to switch SIMs via an unexpected link or phone call

Conclusion

eSIM technology offers great convenience, but it also opens a new avenue for fraud. Scammers are exploiting the ease of digital SIM activation to hijack phone numbers and steal funds. In India and around the world, losses have been severe. However, this crime relies entirely on tricking the user. By understanding the scam steps and following the safety tips above, anyone can protect themselves.