Guarding Our Elders: A Comprehensive Report on the Elder Fraud Epidemic in India

The Silent Threat: India’s Seniors in the Digital Crosshairs

India is undergoing a major demographic and digital shift. The senior population (aged 60+) is projected to reach 193 million by 2031. Simultaneously, this group has quickly adopted digital platforms—a trend accelerated by the pandemic. While this connectivity helps them stay in touch and access services, it also increases their exposure to online risks. Currently, 68% of seniors use platforms like WhatsApp, Facebook, and YouTube, significantly expanding their digital footprint. As a result, they’ve become prime targets for a growing threat: elder fraud.

This is no minor issue—it’s becoming an epidemic. Safer Internet India reports that cybercrimes against seniors rose by 86% from 2020 to 2022. NCRB data confirms a surge in phishing scams, fake ads, and privacy breaches aimed at the elderly. In cities like Chandigarh, a single day’s cybercrimes have caused losses of ₹15–18 lakh, often impacting high-ranking retirees. Digital payment fraud in India is expected to exceed Rs 1.2 lakh crore ($14.4 billion) by 2025. But these figures only hint at the deeper reality: elder fraud is a calculated and predatory crime

While low digital literacy plays a role—45% of seniors admit difficulty spotting scams—this alone doesn’t explain the scale. Criminals are conducting psychological warfare, targeting the emotional, social, and neurological traits of elders.

Key vulnerabilities include:

- Hijacked Trust & Politeness: Many seniors were raised to respect authority and be polite. Scammers impersonate officials—bankers, police, government agents—knowing seniors are more likely to comply without question.

- Weaponized Loneliness: Many older adults live alone or apart from family. Scammers exploit this by pretending to offer companionship. Romance scams and emotional cons flourish by simulating connection.

- Financial Stability: Seniors often hold savings, pensions, and property, making them lucrative targets. Fraudsters aim for large paydays, not petty theft.

- Neurological Factors: Aging can reduce activity in the anterior insula—the brain area linked to distrust. Coupled with slower cognitive processing, this makes it harder for seniors to detect manipulation, especially under pressure.

- Triggers of Fear, Ignorance, and Greed: As RBI officials note, most scams use one of three emotional levers—fear, ignorance, or greed. From fake KYC alerts to bogus investment schemes, scammers exploit these triggers to provoke emotional, not rational, responses. Elder fraud isn’t random—it’s a systematic strategy exploiting the psychological and social traits of its victims. The tactics are finely tuned to override reason and evoke emotion. Combating this crisis requires more than technical awareness—it demands deep insight into the scammer’s psychological toolkit.

The Scammer’s Playbook: A Detailed Anatomy of Elder Fraud Schemes

Fraudsters targeting the elderly operate with a diverse and adaptable portfolio of schemes. They don’t rely on a single method but often combine tactics into multi-stage attacks that escalate in pressure and complexity to maximize financial gain. Understanding this playbook is the first step toward building effective defences. These scams fall into three main categories based on the primary psychological lever they exploit: fear, digital unfamiliarity, or greed.

1. Impersonation and Authority Scams (Exploiting Fear and Trust)

These scams rely on fear and manufactured authority. The scammer creates a crisis that only they can “resolve” if the victim complies immediately.

- Digital Arrest / Police Impersonation: One of the most cruel and effective scams. Fraudsters pose as officials from agencies like the CBI, ED, customs, or local police. They accuse the victim of serious crimes—like their Aadhaar being used in a money-laundering case or an illegal parcel in their name. Some go as far as staging fake Supreme Court sessions via video calls using actors as judges and investigators. The terrified victim is pressured into paying large “refundable” fees to settle fake charges—often losing lakhs or crores.

- KYC/Bank/OTP Scams: A common scam where criminals impersonate bank staff. Victims receive calls or texts claiming KYC has expired or their card/account is at risk. Urged to act quickly, they share sensitive details like OTPs or PINs, which scammers use to drain accounts.

- Grandparent/Family Emergency Scam: Fraudsters pretend to be a distressed grandchild or relative in an emergency—hospitalized, arrested, or stranded. Some use AI voice-cloning to mimic real voices and urge secrecy to prevent the victim from verifying. The emotional pull overrides logic.

2. Technical Deception Scams (Exploiting Digital Unfamiliarity)

These scams exploit digital literacy gaps, creating fake technical problems and charging to “fix” them.

- Tech Support Scam: One of the most widely reported forms of elder fraud. Victims receive alarming pop-ups claiming their computer is hacked. A toll-free number connects them to a fraudulent “agent” who convinces them to grant remote access. The agent runs a fake scan and charges for unnecessary software or repairs.

- Phishing/Fake URL Scams: Victims receive messages with links to fake websites resembling real ones—banks, e-commerce, or government portals. When login details are entered, scammers steal the credentials.

- Fake and Malicious App Scams: Fraudsters create apps that mimic legitimate ones. When downloaded from unofficial sources, these apps steal data, spy on users, or install ransomware.

3. Lure and Greed Scams (Exploiting Financial Aspirations)

These schemes prey on the desire for financial security, offering high but fake returns.

- Investment and Ponzi Schemes: Highly damaging financially. Fraudsters pitch investments in stocks, crypto, or real estate with guaranteed high returns. Fake apps or trading platforms show fabricated profits to lure repeated investments. In a tragic Telangana case, a 75-year-old retired manager lost ₹13 crore—starting with a simple WhatsApp message.

- Lottery/Prize Scams: Victims receive calls, texts, or emails saying they’ve won a large prize. To claim it, they must first pay “processing” or “tax” fees. Once paid, the scammers vanish, and no prize is delivered.

- Pension and Insurance Scams: Scammers pose as officials from pension agencies or insurance firms.16 They claim issues in the victim’s pension or offer to increase payouts for a fee. Others sell fake insurance policies or miracle cures, collecting payments for non-existent services.

This playbook is not rigid. Sophisticated scams often begin as one type and evolve. The ₹13 crore investment scam, for instance, later required the victim to pay “taxes” to withdraw profits, turning it into an authority-based scam. This dynamic, multi-stage nature demands layered defences that recognize threats across the scam spectrum.

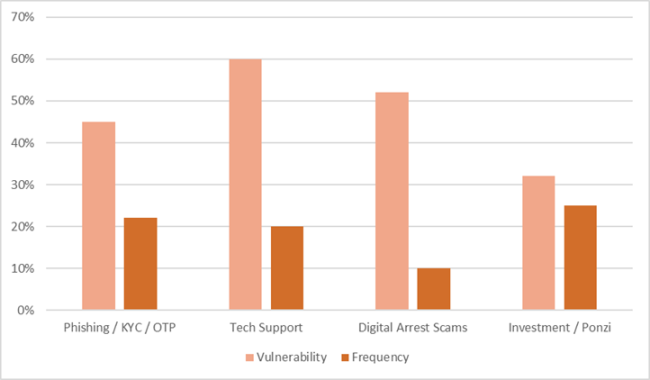

The Fraud Landscape: Scam Frequency vs. Financial Devastation

Not all scams are created equal. Some are high-volume, everyday threats that result in smaller, though still painful, losses. Others are less frequent but can result in catastrophic, life-ruining financial devastation. Understanding this distinction is critical for prioritizing protective measures. The following table analyses the most common elder fraud schemes along two axes: their estimated frequency and their potential financial impact per victim.

| Scam Type | Estimated Frequency | Potential Financial Impact per Victim | Analysis & Supporting Evidence |

| Phishing / KYC / OTP Scams | VERY HIGH | LOW to MEDIUM | These scams are widespread, automated, and commonly distributed in bulk through SMS, email, or messaging apps. Although individual financial losses are often confined to the available balance in a single bank account, they can still be significant. Their extremely high frequency makes them a persistent and ongoing threat. |

| Tech Support Scams | HIGH | MEDIUM | The FBI consistently reports tech support scams as the most frequent type of elder fraud by complaint volume. Losses typically range from a few hundred to a few thousand dollars per incident as victims pay for fake services. |

| Digital Arrest Scams | MEDIUM to HIGH | HIGH to VERY HIGH | These scams are becoming increasingly common in India. They are highly targeted and psychologically intense, often resulting in victims transferring large sums of money—from lakhs to crores—over several transactions to avoid fabricated legal trouble. |

| Investment Scams | LOW to MEDIUM | CATASTROPHIC | While fewer seniors may fall for these scams compared to phishing, the financial impact is unparalleled. The FBI reports investment scams are by far the costliest category, costing US seniors over $1.2 billion in 2023. Indian case studies confirm this, with single victims losing their entire life savings, often running into crores. |

This analysis reveals a crucial risk management principle. A comprehensive protection strategy cannot just focus on the most common threats like phishing. It must also provide robust defences against the less frequent but existentially dangerous schemes like investment and digital arrest scams. This dual focus is essential for safeguarding not just daily finances, but an elder’s entire financial future.

Forging a Human Firewall: A Practical Guide to Protecting Our Elders

While technology helps, the most critical defences against cyber fraud is human. Sophisticated scams bypass technical safeguards by targeting human psychology. Protecting elders means building a “human firewall”—a defence system of awareness, habits, and family support. The goal is not to restrict digital freedom but to empower them with confidence and safety online.

1. Open and Judgment-Free Communication

Scammers rely on shame and silence. Many seniors don’t report fraud out of embarrassment or fear of losing independence. Families must create a safe, judgment-free space for open dialogue.

- Start Regular Conversations: Don’t wait for a problem. Discuss common scams together as family updates, not warnings.

- Encourage Openness: Remind them they can bring up any suspicious activity without fear of blame. Reinforce that anyone, regardless of age, can be targeted.

2. The Verification Reflex: Pause, Verify, Call

Scammers create urgency to force mistakes. This three-step reflex can stop them in their tracks:

- Pause: Do nothing immediately. Real institutions don’t pressure you into urgent decisions or threats. Hang up or close the pop-up.

- Verify: Contact the source directly using trusted channels—bank numbers on cards or bookmarked websites, never links or numbers provided in the message.

- Call: Before acting, talk to a trusted family member. A second opinion often breaks the scammer’s psychological hold.

3. Practical Digital Hygiene

Simple habits can dramatically reduce risk:

- Secret Word: For “grandparent” scams, create a family-only password to verify real emergencies.

- Spotting Red Flags: Teach them to distrust vague greetings like “Dear Customer,” poor grammar, suspicious links, and emails from public domains (@gmail.com).

- Password Practices: Help them use strong, unique passwords—especially for banking and email. A reliable password manager can simplify this.

- Never Share Credentials: Reinforce that no legitimate entity asks for passwords, PINs, or OTPs. These are private digital keys.

4. Use Official Resources

Make sure they know where to turn:

- Cyber Crime Helpline (1930): Report frauds immediately. Fast reporting increases the chances of freezing stolen funds.

- Cyber Crime Portal: cybercrime.gov.in – the official complaint portal.

- “Check Suspect” Tool: I4C’s feature on the portal lets users verify phone numbers, UPI IDs, or websites for past fraud reports.

By fostering open communication and instilling simple digital habits, families can build a strong, proactive shield that empowers elders to stay safe—and confident—in the digital world.

Your Digital Guardian: Comprehensive Protection with Quick Heal AntiFraud

While awareness and communication form the foundation of safety, the scale and sophistication of today’s digital threats demand strong technological support. Scammers use automated tools to flood victims with malicious links and calls, making constant vigilance unrealistic. This is where a dedicated security solution becomes vital—acting as a digital guardian that reinforces safe habits through automation.

Quick Heal AntiFraud is designed specifically to combat the elder fraud threats outlined in this report. It offers a comprehensive safety net for seniors and peace of mind for families.

Rather than just listing features, its real value lies in solving real-world problems. The following analysis connects common elder fraud tactics with Quick Heal AntiFraud’s protective features, showing how it defends at every major risk point. All features are based on the official product datasheet.

Mapping Threats to Quick Heal AntiFraud Solutions

| Threat/Scam Type | Primary Quick Heal AntiFraud Feature | How It Protects |

| Impersonation Calls (Digital Arrest, Bank Fraud) | Fraud Call Alert & Banking Fraud Alert | Instantly checks unknown numbers for potential scams and alerts you during a suspicious conversational call that could lead to financial fraud. This provides a real-time warning when a scammer is trying to manipulate you over the phone. |

| Phishing Links & Malicious Websites | Scam Protection & Browsing Protection | Detects and blocks fraudulent links in emails, messages, or websites. It safeguards your device by blocking access to known malicious sites, preventing you from ever landing on a page designed to steal your credentials. |

| Fake & Malicious Apps | Fraud App Detector | Proactively identifies and alerts you to potentially harmful apps that steal information, spy on you, or infect your device. This stops a threat before it can execute its malicious purpose. |

| Family Member Vulnerability | Fraud Protect Buddy | Enables you to add loved ones who may be susceptible to fraud. This unique feature safeguards them by alerting you to the suspicious calls they receive, creating a remote safety net and allowing you to intervene. |

| Remote Access & Tech Support Scams | Screen Share Alert | Protects your privacy by notifying you when an app attempts to share your screen during a call. This is a critical defense against tech support scams where criminals trick you into letting them take control of your device. |

| OTP Theft & Unauthorized Access | Unauthorised Access Alert & Call Forwarding Alert | Protects your privacy by notifying you when apps access your microphone or camera without your permission. It also alerts you if your calls are being redirected to another number, preventing key tactic fraudsters use to intercept OTPs. |

| QR Code Scams | Payee Name Announcer | Helps you avoid QR code scams by verifying the recipient of your payments. It audibly announces the payee’s name, ensuring your money is going to the intended person and not a fraudster’s account. |

| Data Theft & Privacy Invasion | Dark Web Monitoring, Webcam Protection, Spy Alert | Provides multi-layered privacy protection by monitoring the dark web for your leaked credentials, blocking unauthorized webcam access, and preventing websites from tracking your online activities and browsing history. |

Conclusion: A Call for Collective Vigilance and Proactive Protection

India’s rapid digitization has left elders vulnerable to targeted financial and emotional scams. These aren’t random crimes—they’re calculated attacks exploiting seniors’ trust and age-related vulnerabilities, leading to major financial loss and emotional harm.

The threat is complex and evolving, blending phishing, impersonation, and investment scams. Combating it requires two key pillars:

- Human Vigilance: Open communication, awareness, and habits like “Pause, Verify, Call” can help families build a strong defence against manipulation.

- Technological Support: Tools like Quick Heal AntiFraud offer real-time alerts and protection, covering what human attention might miss.

Both are essential. One without the other leaves seniors exposed. Rather than limit digital access, we must empower elders with knowledge, support, and smart tools. Protecting them is a shared responsibility—and one we must act on now.