Oct

PANCardFraud:Understanding and Preventing Misuse

-

knowlegde-centre / 3 months

- October 27, 2025

- 0

Introduction

The Permanent Account Number (PAN) card is a key financial ID in India, linking tax returns, bank accounts, and other services. In recent years, PAN details have become a prime target for fraudsters as digital transactions and Aadhaar linking have expanded. Investigations note that PAN and Aadhaar misuse are leading causes of banking fraud, especially after mandates to link PAN with Aadhaar and bank accounts.

What Is PAN Card Fraud

PAN card fraud occurs when someone uses your PAN without permission for criminal purposes. In practice this means a fraudster can open bank or investment accounts in your name, apply for loans or credit cards under your identity, or commit tax evasion using your details. When your PAN is misused, it often leads to identity theft.

How Fraudsters Misuse Pan Card

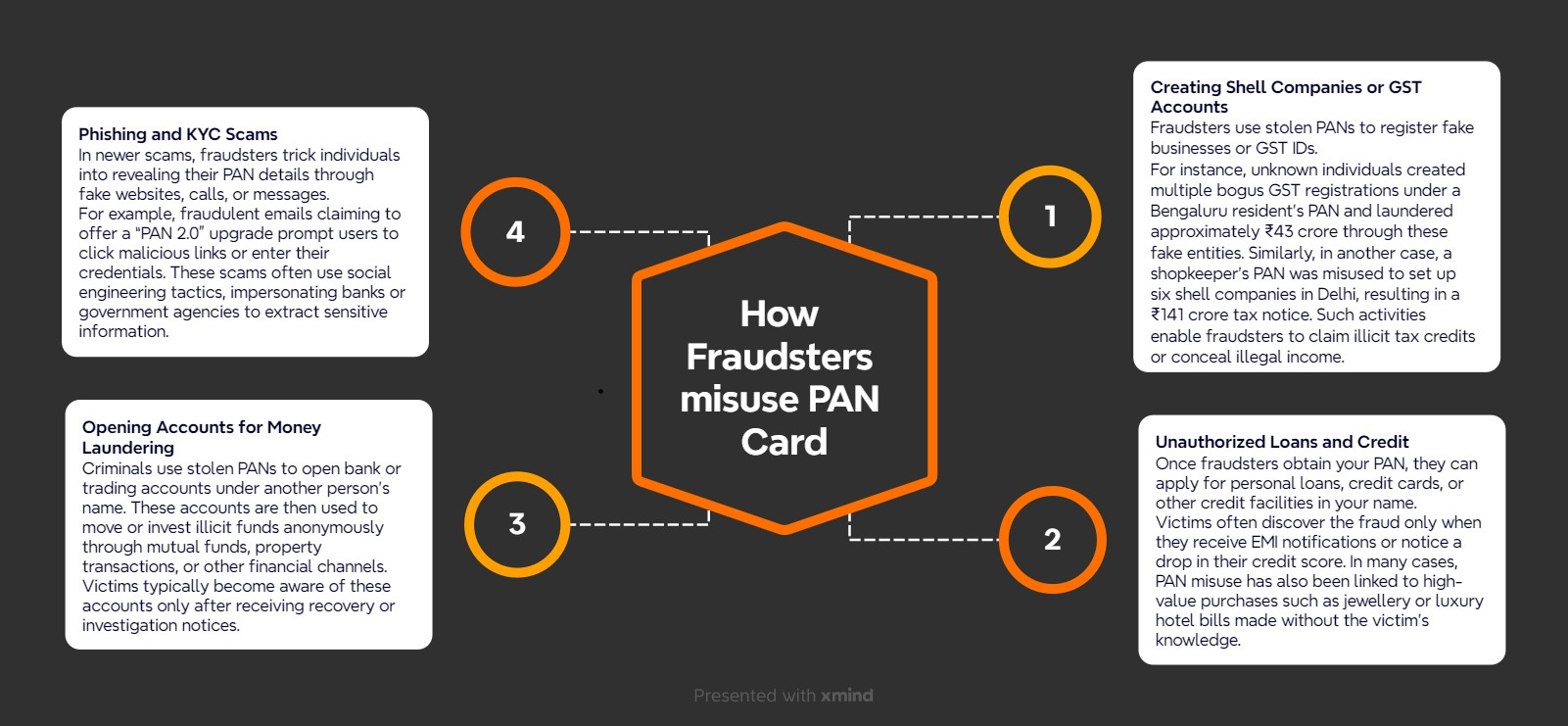

Fraudsters exploit stolen PAN numbers in many ways, often to move large sums or create bogus entities. For example:

-

- Creating Shell Companies or GST Accounts: Criminals have used stolen PANs to register fake businesses or GST IDs. In one case, unknown persons generated multiple bogus Gst registrations under a Bengaluru man’s PAN and laundered about ₹43 crore through those fake accounts similarly, a UP shopkeeper’s PAN was fraudulently used to set up six companies in Delhi, triggering a ₹141 crore tax notice.

-

- Unauthorized Loans and Credit: Scammers can apply for loans, credit cards or other credit facilities in your name once they have your PAN. For instance, fraudsters have obtained personal loans or even high value purchases like jewellery or hotel bills on stolen PANs.

-

- Opening Accounts for Money Laundering: With a PAN, crooks can open bank or trading accounts to move money anonymously. These accounts may be used for transferring illegal funds through mutual funds, property, etc. all in your name.

-

- Phishing and KYC Scams: Newer frauds involve tricking victims into voluntarily giving up PAN details. For example, fake emails promise an upgraded PAN 2.0 card and ask users to click links or enter data. These links steal your PAN/Aadhaar info directly. Some frauds even use social engineering to get you to share PAN details.

Warning Signs That Your PAN Is Misused

Be alert for these red flags, which often signal PAN misuse:

Unexpected Notices or Calls: You might get surprise emails, sms or calls about tax liabilities, loans, or accounts you never opened. Many victims only realize something is wrong when they receive an income tax demand or recovery call for transactions they didn’t make any official looking notice that doesn’t match your records is a warning sign.

Credit Score Drops: If your credit report suddenly shows a lot of debt or a big credit score drop, it could be because someone else took loans in your name. Regularly check your credit score any new loans or high balances will show up.

Unfamiliar Financial Alerts: Watch for SMS/email alerts about new loans or credit cards being approved using your PAN, especially if you didn’t apply for them. Similarly, if your bank or email alerts you of logins or OTPs you didn’t request, someone may be trying to use your PAN linked accounts.

Discrepancies in Tax Forms: Examine your Income Tax statements for example, Form 26AS and the Annual Information Statement (AIS) on the tax e-filing site. If these show income or transactions (like GST or TDS) from businesses or employers you don’t know, that suggests your PAN has been used fraudulently.

What to Do If You Discover PAN Misuse

If you confirm your PAN has been misused, take these steps immediately:

File a Police/Cybercrime Report: Lodge a FIR with your local police or cyber crime cell. You can file an online cybercrime complaint at cybercrime.gov.in (the government’s Cyber Crime Reporting Portal).

Inform the Income Tax Department: Report the fraud on the Income Tax Department’s TIN-NSDL portal. , fill out the PAN misuse complaint form as instructed. This alerts tax authorities that your PAN has been compromised.

Notify Banks and Creditors: Contact your banks and lenders to warn them of the fraud. Ask them to freeze new loans or credit cards in your name and flag your accounts for monitoring.

Monitor and Secure Your Accounts: Change passwords on your financial and email accounts immediately, enable two factor authentication, and ensure your contact information (mobile/email) on record is up to date.

Obtain a New PAN if Necessary: In extreme cases (if your PAN has been heavily compromised), you may apply for a reissued PAN.

How to Prevent PAN Card Fraud

Staying aware is key. Here are some proactive precautions to protect your PAN:

Keep PAN Private: Don’t share your PAN number casually. Only give copies of your PAN card when absolutely necessary, and then only via secure channels. Avoid uploading PAN details on untrusted websites or social media.

Self-Attestation: Always sign, date, and mention the purpose on PAN photocopies before handing them over.

Use Official Portals Only: Whenever you need PAN related services like linking Aadhaar, filing returns, or applying for e-PAN, go directly to the official government websites (incometax.gov.in, tin-nsdl.com or utiitsl.com).

Monitor Your Accounts: Treat your PAN like a financial asset. Link your PAN with Aadhaar and with your mobile number. This linkage helps in tracking and sends you alerts. Regularly log in to your bank and PAN filing portals to check for unknown transactions.

Enable Security Features: Activate two factor authentication (2FA) on email and financial apps. Set up SMS alerts for any transaction or new account opening in your name.

Legal Recourse & Consumer Rights

If you suspect or discover your PAN has been misused, prompt legal action can help restore security and accountability:

Report Immediately: File an official complaint at the Income Tax Departmentʼs portal and inform your bank.

FIR Lodging: Register a First Information Report with the local police for a formal legal record.

Credit Bureau Notification: Tell CIBIL or other credit bureaus about the misuse to dispute unauthorized entries.

Block or Freeze PAN: Request authorities to block your PAN card if needed to prevent further misuse.

Keep Records: Maintain all complaint correspondence and evidence for future reference.

PAN Card Misuse Complaint: Step-by-Step Process

If you suspect that your PAN card has been misused, follow these steps to file an official complaint through the Tax Information Network (TIN) portal:

1. Visit the Official Portal :

Go to the Tax information Network

2. Open Customer Care section :

On the homepage, locate and click on the ‘Customer Care’ option at the top right corner.

3. Select Complaint option :

From the drop-down menu, choose ‘Complaints/Queries’.

4. Fill Out the Complaint Form :

-

- Enter all required details (like name, contact info, PAN, etc.).

-

- Clearly describe the issue or misuse of your PAN.

- Complete the verification captcha.

-

- Click ‘Submit’ to register your complaint.

- Clearly describe the issue or misuse of your PAN.

Stay Protected from Frauds with Quick Heal

PAN card frauds and phishing scams have emerged as major threats to personal and financial security. Cybercriminals continuously devise new ways to deceive individuals, often through convincing messages, fake links, or fraudulent calls, aiming to steal sensitive information. Protecting yourself begins with awareness and vigilance.

Always remain cautious when sharing personal details, especially your PAN information, and ensure you verify the authenticity of any communication claiming to be from trusted institutions.

Regularly reviewing your financial records can help detect unusual or unauthorized activity at an early stage. If you ever suspect misuse of your PAN card, act promptly by reporting it to the appropriate authorities to prevent further damage. By staying informed and practicing digital hygiene, you can effectively reduce the risk of falling victim to such frauds.

Strengthen your online safety with Quick Heal Total Security a comprehensive security solution designed to safeguard your devices from phishing attempts, data breaches, and identity theft. Stay alert. Stay secure. Stay protected with Quick Heal !!

References:

Contributors:

-

- Krishna Arun Iyer

- Rahul Mishra

- Deepak Patil