Jul

Inside the Trap: How AI Trading Scams Are Fooling Investors

-

Aayush Chandhere / 8 months

- July 2, 2025

- 0

Artificial Intelligence has changed the way we trade and invest. From automating decisions to predicting market trends, AI is making finance smarter. But just like every powerful tool, it has a dark side — and that’s where AI trading scams come in. These scams are designed to look smart, sound convincing, and feel completely trustworthy — but they’re built to deceive, manipulate, and disappear with your money.

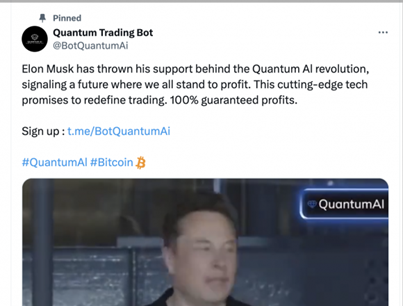

Imagine scrolling through social media or checking your messages, and you see an ad or a forwarded message about an AI-powered trading platform. It promises big returns, little effort, and may even feature a well-known celebrity or business figure endorsing it. The website looks polished, charts are moving, profits appear to grow — everything feels legit. But behind that professional look is a trap.

These scams are not run by amateurs. They’re carefully planned to gain your trust — sometimes even allowing small withdrawals at first to seem genuine. But soon, they start asking for bigger investments, and when you try to withdraw your money again, the site blocks access, support vanishes, and the money’s gone.

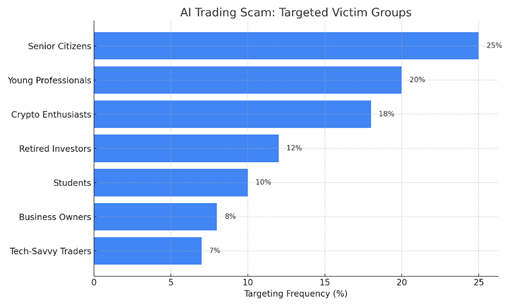

AI trading scams are on the rise, and anyone can fall for them — retirees, professionals, students, even tech-savvy users. In this blog, we’ll break down how these scams work, why they’re so effective, share recent real-life cases from India, and show how tools like Quick Heal’s AntiFraud.AI can help detect and stop them early. We’ll also give you a handy checklist to help you spot red flags and stay safe. Because today, a little awareness can save you a lot of money — and peace of mind.

→ Step-by-Step Breakdown of the Scam

# Promises of High Returns

Scammers run some flashy ads on social media platforms, email or via SMS to draw the attention of the people. These ads highlight the terms like “AI-powered trading”, “Automated success” or “Smart investing” by which the user gets attracted and click on the website link.

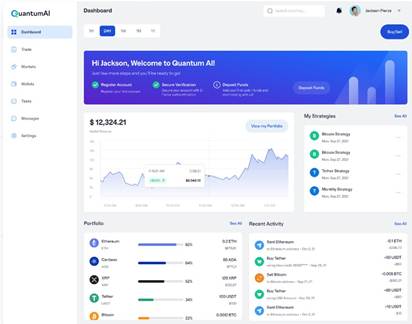

# Professional-Looking Platform

Once the user gets redirected to the website or app, they see a modern and well- designed dashboard which displays- Fake profile charts, Simulated market data, Positive account growth. Everything appears real, but it’s fully scripted or manipulated.

# Small Gains and Early Withdrawals

To build trust, users may be allowed to withdraw small profits in the beginning. This builds the trust of user towards the platform’s legitimacy and encourages them into invest more amount.

# Larger Deposits Requested

After a few wins, users are prompted to deposited more for better results. This is the critical phase where scammers push victims to invest large amounts.

# The Collapse

Once a large amount is invested, things change- Withdrawals are blocked, Support becomes unreachable etc. Eventually website disappears or stops functioning.

# Disappearing Without a Trace

Funds are routed through untraceable payment processors. Victims are left with no clues, often rebrand under a new to start again.

Fake Elon Musk Endorsement Used to Promote AI Trading Scam

→ Targeted Victim Groups in AI Trading Scams

The bar graph shows how often different groups of people are targeted in AI trading scams, based on real cases and fraud trends seen in India, the UK, and the US.

→ Recent Cases

- 79-year-old Bengaluru woman duped of ₹35 lakh (June 2025)

A 79-year-old retired woman from Bengaluru lost ₹34.6 lakh to a fake AI trading scam. It all started with a Facebook ad that showed a deepfake video of Infosys co-founder NR Narayana Murthy, falsely promoting an investment platform that promised high returns using AI. Over the next eight months, scammers pretending to be financial advisors convinced her to keep paying money for things like taxes, service charges, and paperwork. When she tried to withdraw her money, the platform kept delaying and asking for more. That’s when she realized it was a scam and filed a police complaint. The case is now under investigation for cheating and impersonation.

2. Retired IAS Officer in Hyderabad Loses ₹3.37 Crore in Online AI Trading Scam (June 2025)

A retired IAS officer from Hyderabad lost ₹3.37 crore to an AI trading scam after receiving a message on WhatsApp that promised big returns on investments. Trusting the offer, he downloaded what seemed like a genuine trading app and, over time, was convinced by the scammers to transfer money in several instalments. It was only when he tried to withdraw his earnings and got no response that he realized something was wrong. By then, the scammers had vanished. He reported the incident to the police, and the Cyber Crime team is now investigating the case.

→ How Quick Heal AntiFraud.AI Can Help Prevent AI Trading Scams

🔐 1. Catching Scam Messages Early (SMS & WhatsApp)

AI trading scams often begin with a message offering “high returns” or asking you to sign up on a flashy-looking website. AntiFraud.AI can detect these suspicious links and automatically send such messages to your spam folder, so you never even see them.

📌 Benefit: It cuts off the scam before you ever click the link or visit the fake site.

🌐 2. Website May Open, But Protection Isn’t Over

If the scam site isn’t blacklisted yet, it might still open. But AntiFraud.AI doesn’t stop working there. It can still:

- Warn you through browser tools if the site looks suspicious

- Update its blocklist in real time to catch new scam websites

- Detect shady behaviour, like fake login pages or spoofed security certificates

→ AI Investment Safety Checklist

| Checkpoint | Legitimate Platform | AI Scam Platform |

| Regulatory Registration | ✅ Yes | ❌ Fake or None |

| Real-Time Trade Execution | ✅ APIs, Broker Integrations | ❌ Simulated Only |

| Whitepaper/Technical Docs | ✅ Usually Provided | ❌ Missing or Plagiarized |

| Transparent Team Info | ✅ Public, Verifiable | ❌ Stock Images or Fake Bios |

| User Reviews | ✅ Mixed, Realistic | ❌ Too Positive or Duplicated |

→ Conclusion

AI trading scams are popping up everywhere, and they’re getting smarter day by day. They often look like real investment opportunities — with polished websites, deepfake videos, and fancy terms like “AI-powered trading.” At first, you might see small profits, but it’s just a trap. Soon, withdrawals stop, support disappears, and the money is gone. Real stories show that anyone can be targeted — whether you’re retired or tech-savvy. That’s why it’s so important to stay alert, question everything, and double-check before trusting any platform. In today’s online world, a little awareness can go a long way in keeping you safe.